After completing our survey last spring, we conducted 52 follow up interviews with individuals who owned residential rental property in Cleveland, Des Moines, Minneapolis, and Tampa. The survey revealed that many landlords were experiencing pandemic-related stress in their rental business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the purpose of the survey, evidence of stress included reports of rent arrears being more frequent, premature vacancy being more frequent, increased vacancies, increased difficulties getting new leases signed, and anticipated declines in cash flow. The surveys did ask respondents if they had filed for eviction, but given the variation in how the moratoria were interpreted and enforced from state to state and city to city, we could not rely exclusively on that answer as an indicator. In other words, on the survey, a respondent might have answered that they had not filed for eviction since the beginning of the pandemic, but that did not mean that they were not experiencing pandemic-related stress., and those who did report that they had filed for eviction always reported stress in one of the other areas already mentioned. The interviews provided us with an opportunity for us to ask finer-grained questions about individual portfolios and the impacts of the pandemic.

The interviews took place in March - May, 2020. The CDC eviction moratorium was still in place, which meant that not every property owner was able to use eviction as a remedy for challenges they might have been experiencing with the tenants of their units. Although some definitely were. The interviews were open-ended and focused on the following five themes: portfolio details, pandemic-related impact on business, responses to the pandemic impact, assistance used, and future plans for rental business. Open-ended means that some questions were set for example, “How has the pandemic affected your business?”, but we were free to use unique follow up questions that were tailored to the particular circumstances of the person we were talking to (for example, “Tell me why you decided to expand your portfolio to include properties in Cleveland?”). All interviews were carried out remotely, either through Zoom video calls or phone calls. Respondent locations varied from living in the same city where they owed properties and where we were located to living in other states to living in Europe. The calls lasted from 20 minutes to over an hour, but most lasted between 30 and 45 minutes. As a reminder, all of our study participants were non-institutional investors for at least one residential rental property, although some had mixed portfolios that including institutional property investing as well. Participants were chosen from the population that volunteered to participate in a follow up interview and had reported at least one indicator of pandemic-related stress in their survey answers.

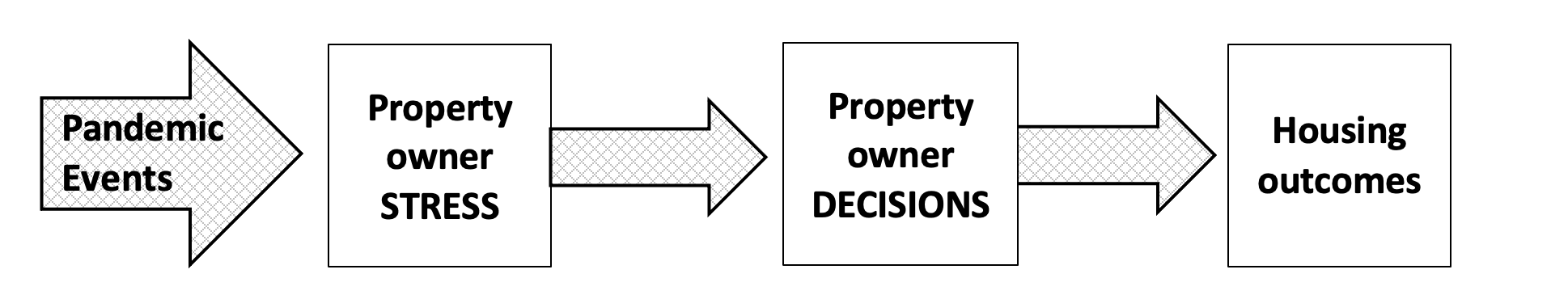

We will be analyzing the interview data for the next few months. Today I will talk about our preliminary findings from our initial coding of the interview data: the big themes that we identified when we analyzed the interviews. For our first cut through the data, we were looking to better understand the idea of stress. We understand stress as an independent variable that has a relationship to the decisions that property owners made regarding their residential rental properties during the pandemic, decisions that ultimately affected housing outcomes for tenants and their communities. Here is a very simple model of what I am describing:

The surveys revealed something about the stress that residential rental property owners were experiencing in terms of what we came to describe as tenant-related stress. The interviews revealed that pandemic-related stress was in fact multi-faceted. Tenant-related stress was one dimension. However, property owners also experienced unit-related stress, business-related stress, regulation-related stress, and stress related to personal circumstances. The chart below provides an overview of the five dimensions of pandemic-related stress.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The public discourse regarding rental properties during the pandemic has tended to focus on the eviction moratorium. What we learned from these interviews is that to really understand the challenges that rental property owners confronted during this time, we need to take a more nuance and detailed view of the idea of rental stress from the perspective of property owners. Residential rental property owners supply housing, and some of them feel very passionately about the social importance of the work that they do. However, while the product they supply is a public good, at the end of the day, residential rental property owners are small business owners. Understanding the multi-faceted dimensions of stress that they experience during disasters will help us better ensure that our cities maintain housing stability during and after disasters.